Every year, the TPG Awards honor excellence in credit cards, loyalty programs and travel. Please click here to read more about our winner selection process and methodology for the 2024 TPG Awards.

It’s time for the 2024 TPG Awards, and to the surprise of no one, Chase has snagged the award for Best Travel Rewards Credit Card for the seventh year in a row.

A consensus favorite among TPG staffers, the Chase Sapphire Preferred® Card is again taking home the title of Best Travel Rewards Credit Card. That’s thanks to its low annual fee, ability to earn Chase Ultimate Rewards points, excellent roster of transfer partners, ease of use and generous travel benefits and protections.

The Sapphire Preferred was my first travel rewards credit card, getting me into the world of points and miles. This card is great for beginners and experts alike and will continue to be in my wallet for years to come.

Let’s explore why the Chase Sapphire Preferred has been named the top travel rewards card year after year.

Great for beginners

The Chase Sapphire Preferred is the little sibling of the Chase Sapphire Reserve®, a premium travel rewards card with a $550 annual fee. The Sapphire Reserve has more benefits and perks than the Sapphire Preferred, but the Sapphire Preferred wins on simplicity and ease of use.

Additionally, if you’re new to the world of points and miles, the welcome offer on the Chase Sapphire Preferred can jumpstart your journey with a nice stash of what we consider the most valuable rewards currency (along with Bilt Rewards Points).

Currently, new applicants can earn 60,000 bonus points after spending $4,000 within the first three months of account opening. Based on TPG’s December 2024 valuations, this welcome offer is worth a solid $1,230.

Related: Chase Sapphire Preferred vs. Sapphire Reserve: Should you go mid-tier or premium?

Low annual fee

The Chase Sapphire Preferred has a modest $95 annual fee that is comparable to that of its mid-tier travel rewards card competitors.

While you won’t get perks like lounge access or travel statement credits, you will get a solid card with excellent earnings rates and useful perks. This annual fee is much more reasonable for those just getting into the world of credit cards with annual fees or those looking to upgrade from a no-annual-fee card to a mid-tier card.

The card also comes with an annual $50 hotel credit for any hotel booked through Chase Travel℠ that is straightforward to use. If you utilize this credit, the effective annual fee drops to only $45.

Related: The complete guide to credit card annual fees

Valuable bonus categories

While there are many travel rewards cards with multiple bonus categories, the Sapphire Preferred outshines most. That’s because the bonus categories are broad, there are no spending caps and purchases made abroad are eligible for bonus points. The card earns flexible rewards in the form of Chase Ultimate Rewards points.

The Sapphire Preferred earns:

- 5 points per dollar spent on travel booked through Chase Travel

- 5 points per dollar spent on Lyft rides (through March 2025)

- 5 points per dollar spent on Peloton equipment and accessory purchases of $150 or more (through March 2025, with a limit of 25,000 bonus points)

- 3 points per dollar spent on dining, select streaming services and online grocery store purchases (excludes Target, Walmart and wholesale clubs)

- 2 points per dollar spent on all other travel not booked through the Chase Travel portal (travel is broadly defined by Chase and includes things such as parking, tolls, ferries and campgrounds)

- 1 point per dollar spent on everything else

These are some of the best earnings rates on the market; while there are a few other cards with higher earnings rates in certain categories, these cards usually carry higher annual fees or are limited by spending caps in select bonus categories.

Whether you’re a beginner or an expert, these bonus categories can help you maximize your earnings and get you closer to your next trip.

Related: 6 reasons why the Chase Sapphire Preferred is the perfect card for the average traveler

Flexible redemptions and transfers

The Chase Sapphire Preferred earns Ultimate Rewards points that can be redeemed in several ways.

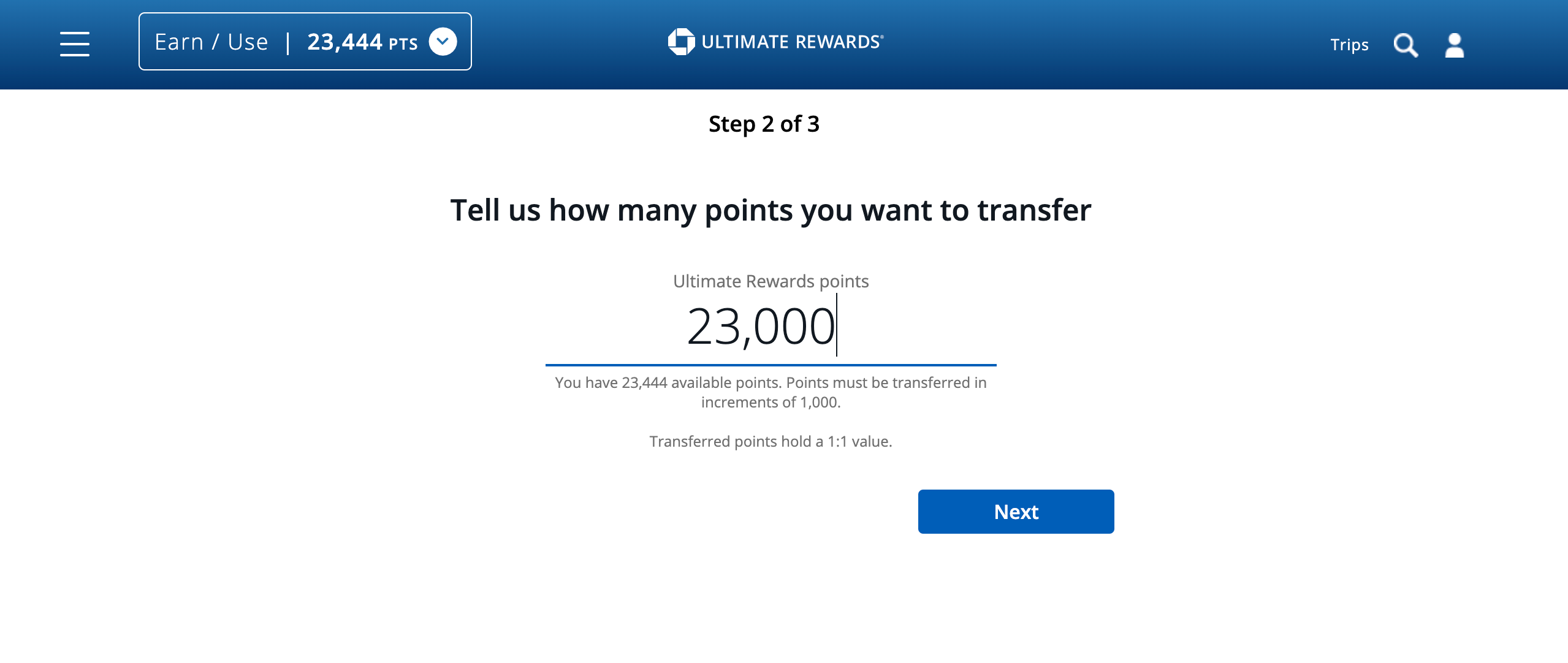

They can be redeemed for travel booked through the Chase Travel portal at 1.25 cents per point, a statement credit at 1 cent per point (at times higher if you use Chase’s Pay Yourself Back feature) or gift cards at 1 cent per point.

You can also redeem them by transferring them to partners, our favorite redemption option. Based on TPG’s December 2024 valuations, Ultimate Rewards points are worth 2.05 cents each through this redemption route.

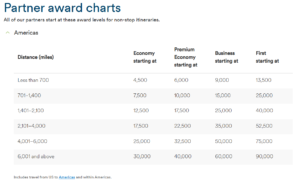

Chase has a roster of 14 transfer partners, including 11 airline and three hotel partners. Transferring and redeeming points is relatively easy, making this useful for beginners. Many transfer partners have incredible sweet spot redemptions where you can get outsize value for your points.

My three favorite Chase transfer partners are Air Canada Aeroplan, Southwest Rapid Rewards and World of Hyatt. The latter has gotten me outstanding hotel redemptions worldwide at properties like the Grand Hyatt Barcelona, where I routinely get up to 4 cents per point in value.

Related: When and how to transfer Chase Ultimate Rewards points to World of Hyatt

Travel protections and perks

The Chase Sapphire Preferred is loaded with various travel protections and insurances that alone could help justify the annual fee. These include:

- Baggage delay insurance

- Lost luggage reimbursement

- Primary rental car coverage

- Purchase protection and extended warranty protection

- Trip cancellation insurance

- Trip delay insurance

Even if you travel only once or twice a year, these protections can add peace of mind in case your travel plans go awry. Additionally, the purchase and extended warranty protection can be beneficial for large purchases.

Bottom line

It’s clear why TPG staffers (both beginners and experts ourselves) often recommend the Chase Sapphire Preferred. With its valuable earnings rates, useful protections and benefits, access to transfer partners and low annual fee, the Sapphire Preferred is worthy of taking the crown home again as the Best Travel Rewards Credit Card.

To learn more about the card, read our full review of the Chase Sapphire Preferred.

Apply here: Chase Sapphire Preferred