Editor’s note: This is a recurring post, regularly updated with new information and offers.

The Amex EveryDay® Credit Card from American Express is a solid card for beginner travelers who can’t yet justify an annual fee. It’s a solid option for anyone searching for a card without an annual fee. While the earning rate and other perks are nothing to write home about, it still grants full access to the popular Membership Rewards program. Card Rating*: ⭐⭐⭐

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

I remember the thrill of getting my first travel credit card, earning the welcome bonus and using it to book my first award flight redemption. Growing up in a family that didn’t believe in credit cards, it was the first time I’d seen firsthand how the right card could help me see and do things that my budget otherwise couldn’t accommodate. It also introduced me to the industry that would lead me to join this amazing TPG team one day.

Starter travel rewards cards like the Amex EveryDay® Credit Card, while not as lucrative as the big-name cards, have the power to show beginners what they can do with some strategic card spending. It also has no annual fee and a recommended credit score of 670.

With that in mind, let’s walk through Amex’s introductory card for its Membership Rewards program.

The information for the Amex EveryDay card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex EveryDay pros and cons

| Pros | Cons |

|

|

Amex EveryDay welcome offer

Right now, you’ll earn 10,000 bonus points after you make $2,000 in purchases within the first six months. According to TPG’s June 2024 valuations, the bonus is worth $200, which is on par with similar no-annual-fee cards. At best, this is a modest offer, but it’s easy to achieve and can get you a nice head start on earning with the card.

Keep in mind that American Express does have a once-per-card-per-lifetime limit on welcome bonuses. Specifically, you can only earn a bonus if you’ve never held the card before. That means you want to make sure you hit the bonus the first time around because you won’t be able to in the future.

Related: The best welcome offers this month

Amex EveryDay benefits

This is a starter credit card, so it doesn’t offer many perks. However, two key benefits give this card a leg up on its competition.

Unlike most no-annual-fee cards, the Amex EveryDay gives you full access to the Membership Rewards program and all the value that comes with it. That means you don’t even need another Amex card to take advantage of the issuer’s transfer partners. While you may not have a lucrative earning structure with this card, you are earning some of the most valuable points available.

Also, as with all Amex Membership Rewards cards, you’ll get access to ShopRunner’s free two-day shipping on eligible orders, the Global Assist Hotline, and car rental loss and damage insurance. Enrollment is required for select benefits.

Related: Ultimate guide to Amex Membership Rewards

Earning points on the Amex EveryDay

You’ll earn 2 points per dollar on travel booked through Amex Travel and on your first $6,000 spent at U.S. supermarkets per year (then 1 point per dollar) and 1 point per dollar on everything else. It’s not a particularly exciting earning rate, but if you max out the supermarket bonus category alone, that’s $240 in rewards value throughout the year.

You’ll get a unique 20% bonus on all spending when you make 20 or more purchases in a month. Assuming you hit that threshold every month, you’ll earn 2.4 points per dollar on Amex Travel and supermarket spending (a nice 4.8% return) and 1.2 points per dollar (2.4% return) on everyday spending based on TPG valuations.

Related: Best grocery credit cards

Redeeming points on the Amex EveryDay

With Membership Rewards, you can get a lot of value from each point.

You’ll get 1 cent per point when you redeem the points directly for airfare at Amex Travel and less than 1 cent per point when redeeming for hotel rooms.

While you can use your points as cash back, Amazon purchases, gift cards and more, you’ll ultimately get the best value when you redeem your points for travel. Specifically, you can maximize your points by utilizing Amex’s airline and hotel transfer partners (see below).

Transferring rewards on the Amex EveryDay

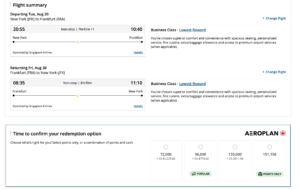

TPG’s June 2024 valuations put Membership Rewards points at 2 cents apiece, thanks largely to the program’s airline and hotel transfer partners. Those include at least one helpful option in each major airline alliance (SkyTeam, Star Alliance and Oneworld).

Transferring your points to the right airline or hotel program is usually the best way to maximize your Membership Rewards points value.

TPG managing editor Matt Moffitt likes to transfer and redeem his Membership Rewards points by taking advantage of transfer bonuses. He especially loves to transfer his points to Iberia Plus for lie-flat seats to Madrid.

Related: The best ways to use your Membership Rewards points

Which cards compete with the Amex EveryDay?

There’s no shortage of competitor cards with annual fees of $100 or less.

- If you want more Amex perks: The Amex EveryDay® Preferred Credit Card has an annual fee of $95 and also earns Membership Rewards points. Plus, if you make 30 or more transactions in a billing cycle, you’ll get a 50% boost on your earnings. For more information, read our full review of the EveryDay Preferred.

- If you prefer Chase: Go for the Chase Sapphire Preferred® Card. It earns 2 points per dollar spent on travel and 3 points per dollar spent on dining, and both of those categories are very loosely defined. And since the bonus categories on this card don’t overlap with the Amex EveryDay Preferred, you shouldn’t consider these cards mutually exclusive. For more information, read our full review of the Sapphire Preferred.

- If you prefer cash back: Look into the Blue Cash Preferred® Card from American Express (see rates and fees). You’ll earn 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1% thereafter), 6% cash back on select U.S. streaming services, 3% cash back at U.S. gas stations, 3% cash back on transit and 1% back everywhere else. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. For more information, read our full review of the Blue Cash Preferred.

For additional options, check out our full list of the best travel cards.

The information for the Amex EveryDay Preferred Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Amex EveryDay vs. Amex EveryDay Preferred: Which should be in your wallet?

Is the Amex EveryDay worth it?

All in all, this is not a bad travel card for beginners in the points world because you’re earning valuable Membership Rewards on eligible travel and supermarket purchases without paying an annual fee. While there are other starter cards with higher earning rates, the rewards you earn won’t be as valuable until you pair those cards with a higher-tier card down the line.

Bottom line

If you want to get started with travel rewards, you can do much worse than the Amex Everyday card.

You can’t go wrong with Amex Membership Rewards cards, as they’re some of the most valuable points on the market, and this is the perfect introduction to that program.

Related: The best no-annual-fee credit cards

For rates and fees of the Blue Cash Preferred, click here.