Working at TPG, we get this question a lot: “What credit cards do you have?” People ask what cards we use and what cards they should get on a regular basis. The short answer: It varies.

No two people have the same situation. The right credit card(s) for your wallet can vary based on where you live, your family makeup, travel goals, where you spend money frequently and other factors.

Rather than trying to explain everything, let’s look at some examples of TPG staffers from various backgrounds to see what credit cards we use on a regular basis. From digital nomads to dog moms, new parents to new entrants in the workforce, you should see someone who has something in common with your situation and that may help you get a better understanding of what could be a good credit card for your wallet.

Lynn Brown, features writer

I live in New York City but travel quite a bit, both for work and for fun — usually alone — and while I wouldn’t consider myself a “luxury” traveler per se, I am a big fan of charming, funky or historic hotels. I also love to eat out!

Growing up, I was always told to be very careful with credit cards to avoid getting into too much debt and that opening new credit cards could hurt your credit score. I’m still unlearning some of that, as well as learning about points, miles and the general benefits of these kinds of credit cards overall. I’ll admit that I’m still pretty wary of credit cards with large annual fees, but I did sign up for two recently after suggestions from my TPG coworkers: the Capital One Venture Rewards Credit Card and my newly acquired American Express® Gold Card. I chose those two cards because they seemed like good starter cards for me considering my spending habits. The Amex Gold allows me to earn 4 points per dollar on dining at restaurants, including Uber Eats, and I get up to $10 in Uber Cash each month as a perk from the card, which I can use on Uber Eats. The Venture card offers 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

Related: How does applying for a new credit card affect my credit score?

Neither of these cards comes with too many “dislikes” so far, though I did get a bit of sticker shock from the annual fee on the Amex Gold Card, which is $250 (see rates and fees). I was also a bit disappointed to find that booking hotels through Capital One Travel and other portals mean that I can’t get credit for those nights through hotel memberships like Marriott Bonvoy. However, thus far I’m finding the benefits outweigh the negatives overall.

Jacob Miles, associate video producer

I live in Columbia, South Carolina, and I’m new to using credit cards.

However, after joining the TPG team I learned how useful they can be. I use the Bank of America® Customized Cash Rewards credit card, which I find to be a great starter credit card. It allows me to change the bonus category for extra rewards monthly, so I can make sure it matches my plans. I tend to travel pretty sporadically with my friends, so it’s great for getting rewards from restaurants or groceries. I hope to start traveling solo more in 2023, and this card will be great for that too.

Related: TPG beginners guide: Everything you need to know about points, miles, airlines and credit cards

Capri Whiteley, social media marketing manager

I live in Charlotte, North Carolina, but often take advantage of my remote-worker status to temporarily live in other places. I’m a big fan of road trips and budget-friendly hotel stays since I’m still in my “broke college kid” mindset, despite being two years out of college.

As a newbie to the points and miles game, I got my first rewards credit card less than a year ago. The Chase Sapphire Preferred Card was recommended to me as a great first card since it earns 3 points per dollar on dining and 5 points per dollar on all travel purchased through Chase Ultimate Rewards travel. Since food and travel are by far my top spending categories, it’s been a great fit. But now that I’m starting to get the hang of the game, I’m getting the itch for my next card.

I’ll likely be getting the American Express Gold Card to add a more elevated option to my wallet with perks like up to $120 in annual dining credits (enrollment is required to use this benefit), a $100 experience credit on The Hotel Collection bookings with Amex Travel (requires a two-night minimum stay) and 4 points per dollar at restaurants (including takeout and delivery) and on up to $25,000 in annual purchases at U.S. supermarkets (then 1 point per dollar after that). This is nice since my post-college taste is starting to get a bit more … expensive.

Related: TPG’s beginners guide to credit cards: Everything you need to know

Daniella Ramirez, associate editor

I currently live in a one-bedroom apartment with my partner in south Charlotte. For us, traveling is reserved for special occasions, but when we do, I’m quick to use any available cash back I’ve received. I only use two credit cards: Capital One Quicksilver Cash Rewards Credit Card and the Apple Card.

As a recent 2021 college graduate, I knew I had to apply for my first credit card. At the time, I didn’t know what card was the best option for me. I thought you had to have a good credit score to apply for any card. My parents told me to look into Capital One because students with limited or no credit history can be approved for a credit card. On top of that, my Quicksilver card earns unlimited 1.5% cash back on purchases and has a $0 annual fee.

After about half a year of having this card, I wanted to open up another line of credit. My goal was to have an Apple Card for its unlimited Daily Cash earning and other benefits. But I knew it would be a little more difficult to get because I was still building my credit at the time. After a few more months and some patience, my credit score was finally high enough for me to apply.

It was very rewarding to be able to obtain the card. As a 23-year-old, I know how important it is to build good credit in order to buy a home, travel or buy a new car. Being recently married has amplified those needs and wants.

The information for the Apple Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: How to get started earning rewards with your first credit card

Tarah Chieffi, family travel writer

I travel often with my husband and three young sons, but I also take a lot of solo trips to theme parks in Florida and California to cover those destinations for work (though it doesn’t feel much like work).

I’m a somewhat recent convert to the idea of carrying more than one credit card in my wallet, but I’ve added quite a few during my time so far at TPG. Currently, The Platinum Card® from American Express, Delta SkyMiles® Reserve American Express Card and Marriott Bonvoy Boundless Credit Card are getting the most frequent use.

Because I have been spending so much time in airports lately, the Amex Platinum and Delta SkyMiles Reserve have ensured I can access a Centurion, Priority Pass or Delta Sky Club lounge for a meal and a quiet place to work or call home (enrollment is required for select benefits). After a recent red-eye flight, my Priority Pass membership (thanks to my Amex Platinum card) got me one free hour in the Minute Suites to sleep before my connecting flight home.

The Marriott Bonvoy Boundless is my first hotel rewards card, but the welcome offer of three free nights (each worth up to 50,000 points) after meeting the initial spending requirement was too good to pass up (this welcome offer is no longer available). I made that my primary card while I was working toward the welcome bonus and used one of our free nights during a family vacation to the Grand Canyon. I redeemed the other two nights during an adventure to Germany with my husband to celebrate our anniversary.

Related: How to choose the best credit card for you

Erica Silverstein, cruise content editor

I live in Northern Virginia with my husband and two kids; my ideal vacation involves outdoor spaces and hiking, but you can usually find me doing vacation rental road trips with the family or sailing the seven seas alone or with my girlfriends.

For years, my main credit card has been the United Explorer Card. Despite being surrounded by points and miles experts, I never manage to fly one airline enough to get elite status, so I get my perks through my credit card. I chose United because that’s the airline I fly most often from my home airport — Dulles International Airport (IAD). I use this card predominantly to get a free checked bag for me and a companion, Group 2 boarding, two United Club passes per year, better award availability and 2 miles per dollar spent on United Airlines purchases. This year, I also discovered the $100 Global Entry credit, which was not available the first time I signed up for the program, so I was thrilled to renew my Global Entry membership for free.

Now that I’m with TPG, I clearly had to up my credit card game. I’ve long been wanting lounge access for all the times I disembark a cruise ship and need to wait several hours for my flight. I considered the Amex Platinum (a TPG staffer favorite), but the Capital One Venture X Rewards Credit Card won me over with its access to Priority Pass, Capital One lounges and Plaza Premium lounges, an annual up to $300 travel credit (which I used to soften the blow of a rather pricey one-night stay in London) and its one-time vacation rental credit (as a family traveler, I prefer rentals to hotels). I’m now trying to figure out if I’ll get as much value from the card during the second year and whether it’s worth paying the hefty annual fee again.

Related: How to book a cruise using points and miles

Caroline English, director of marketing

I’m a new parent, living with my partner in New York City.

Before having a baby, my primary points ecosystem was Chase Ultimate Rewards. I’m a big fan of these points, and I love using the Chase Ultimate Rewards portal to book travel. In late 2019, I decided to expand my horizons and get the Amex Gold to start dipping into the Membership Rewards points ecosystem. I was primarily thinking of using these points to take advantage of the periodic sales for booking Delta award flights with just 5,000 miles. I would cover my travel purchases with my Chase Sapphire Reserve and my food and grocery purchases with Amex Gold.

Now that I have a 4-month-old, I just hand over whatever card is easiest. I know it’s bad, and I’m probably leaving so many points on the table, but my rewards on both my Chase and Amex cards are good enough that I don’t think it’s worth the mental energy of figuring out which one can incrementally increase my points total during my current phase of sleep deprivation with a newborn. Every time I get gas, I open my TPG app to help me remember which of my cards earns the most points for gas because it’s a little “in one ear, out the other” right now. I do think that I should probably get a Target RedCard at this point, though, since I buy plenty of diapers and would love to get 5% back on these purchases.

Once I start traveling again, I also plan to get the Capital One Venture X. Many of the perks that Erica mentioned above are attractive to me.

The information for the Target REDcard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Zach Griff, senior aviation reporter

I live in New York City and travel frequently for a number of reasons — between work trips for TPG and personal trips with my wife, family and friends, I’m often on the go.

Dining, travel and groceries are my biggest expense categories. I use a mix of credit cards to maximize my earnings from everyday purchases. I use the Amex Gold primarily at restaurants and U.S. supermarkets because it earns 4 Membership Rewards points per dollar spent in each of those categories (limited to the first $25,000 of U.S. Supermarket purchases per year, then 1 point per dollar). For travel, I usually put that spending on my Chase Sapphire Reserve, which earns 3 Ultimate Rewards points for every dollar spent.

For my non-bonus spending, I’ve been getting a great return with my new Capital One Venture X, which earns 2 Capital One miles for each dollar spent. I’ve recently been using these transferable points for redemptions via Turkish Airlines Miles&Smiles. While it is a bit of a niche program, it offers plenty of value for many Star Alliance partners. It’s worth a look.

Related: Sweet Spot Sunday: Fly coast to coast in a lie-flat seat for 12,500 miles

Ryan Smith, credit cards writer

My partner and I live in Orange County, California, and take a mix of trips to nature, big cities and off-the-beaten-path destinations each year as I try to visit every country in the world.

My wife and I each have over 20 credit cards right now. However, there are four credit cards that have regular places in our wallets. We love The Platinum Card from American Express for its perks like airport lounge access, the ability to get free streaming services and its monthly Uber Cash (which we use for Uber Eats). We purchase airfare with this card since it earns 5 points per dollar if booked directly with the airlines or with American Express Travel on up to $500,000 in purchases per calendar year. Enrollment is required in advance for some of these benefits.

Related: 10 things to do when you get the Amex Platinum

We love the Citi Premier® Card for the fact it earns 3 points per dollar at supermarkets, on gas purchases and on flights and hotels without needing to purchase in a certain way (such as in a specific booking portal) to earn those extra points. Another card we use at the supermarket, and also at restaurants, is the Amex Gold. Cardholders earn 4 points per dollar at restaurants worldwide and on takeout and delivery in the U.S. and 4 points per dollar on the first $25,000 of annual purchases at U.S. supermarkets (then 1 point per dollar). For anything that doesn’t earn bonus points, I tend to put those purchases on my World of Hyatt Credit Card to help me earn a free night award after spending $15,000 on the card each calendar year.

Katie Genter, senior points and miles writer

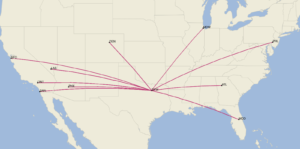

My husband and I sold or donated most of our belongings and moved out of our Austin, Texas, apartment in 2017 to become digital nomads. Although we bought an RV during the pandemic, we’re now back to spending most of our time outside the U.S. hopping countries and living out of hotels while working remotely.

Like Ryan, my husband and I have more than 20 credit cards each right now. We don’t carry all of our cards on the road, but we do carry multiple hotel credit cards — including the Marriott Bonvoy Boundless Credit Card, IHG Rewards Premier Credit Card and World of Hyatt Credit Card — to earn bonus points on our hotel bills. And we carry our Amex Platinum cards for Centurion Lounge access, 5 points per dollar on flights booked directly with airlines (up to $500,000 of these purchases per year) and access to booking hotels through the Fine Hotels + Resorts program.

Related: Here’s your guide to the Amex Platinum prepaid hotel credit

We love earning 5 points per dollar on dining and travel agencies with my Citi Prestige® Card (which is no longer open for sign-ups) and getting 3 points per dollar spent at gas stations, supermarkets and hotels with the Citi Premier® Card. Best of all, both Citi cards let us double dip on rewards with the SimplyMiles and Citi Merchant Offers programs.

The information for the Citi Prestige Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The Ink Business Preferred Credit Card continues to hold a key place in our wallets due to its 3 points per dollar on general travel expenses (on up to $150,000 spent in combined purchases in select categories each account anniversary year). And the Capital One Venture X Rewards Credit Card is a relatively new addition to our wallets, but we love two benefits of booking flights through the Capital One travel portal with the Venture X: price-drop protection and earning 5 miles per dollar spent. Plus, we use the Venture X as our everyday spending card due to its earning rate of at least 2 miles per dollar on all purchases.

Andrea Rotondo, director of content operations

My husband and I live near Jacksonville, Florida. I have three cards in my wallet that I use for 99% of my daily spending: Chase Sapphire Reserve, Amex Platinum and the World of Hyatt card.

I don’t include an airline-branded credit card on that list because I’m lifetime Gold on American Airlines and, when I fly, I normally either book award tickets in first class or business class or just buy the seat I want. So, field upgrades aren’t a motivating factor for me. While American’s move to Loyalty Points piqued my interest, the potential benefits didn’t move me enough to change my spending habits.

Back in January, I decided to devote a good chunk of my daily spending to my World of Hyatt card. I earned top-tier Globalist status with Hyatt the previous year and enjoyed the perks. My favorite benefits are waived resort fees on both award stays and paid stays (on certain room rates), free breakfast or Club access and room upgrades. And, frankly, Hyatt employees do a great job of making Globalists feel welcome and appreciated. That convinced me that it was worth the spending if it helped ensure I keep my Globalist status for 2023. Fast forward a few months and I had a health crisis that put me on the no-fly list for three months. In hindsight, I might have more seriously thought about shifting my spending habits since I had to cancel three Hyatt-based trips during that time period. I didn’t, though, and now it will just take a few end-of-year weekend getaways to make sure I hit Globalist status for next year. It gives me a good excuse to book a trip to see my nephew perform in a school musical this fall and visit friends that I won’t otherwise meet up with before the year’s end.

Related: Use the World of Hyatt credit card to earn Globalist elite status

I then evenly distribute the rest of my spending to my Chase Sapphire Reserve and Amex Platinum. I love both of these cards for the flexible points that can be transferred to other loyalty programs. I’ve transferred Chase Ultimate Rewards to my Hyatt account on a number of occasions. And I like the option of transferring Amex Membership Rewards points to ANA, where I can often book business-class awards to Europe for fewer miles than if I used miles from another airline.

I have other credit cards, but those three are my favorites and where I’ve focused my spending in 2022. As we near the end of the year, it’s time for me to reassess my plans for credit card spending for next year and see what cards may be missing from my wallet.

Bottom line

As you can see, the credit cards we use every day aren’t all the same. The best credit card for each person varies depending on their spending habits, what perks and benefits are important to them and how they plan to use the rewards they earn with the card. There’s not one, singular “best credit card for everyone.” Instead, it’s important to look at where you spend money regularly and see which credit cards will earn extra points on those purchases, plus evaluate what types of benefits you want from your credit card.

If you’re new to the idea of credit cards, points and miles, head over to our beginners guide to learn more.

For rates and fees of the Amex Gold Card, click here.