The word timeshare is often associated with the same sneaky, slimy vibes that emanate from the backrooms of the car dealership during sales negotiations. They both are thought to involve high-pressure sales tactics, a big loss in value the second the purchase is made and rash decision-making you may regret later.

I don’t dispute those things are often quite true, but my timeshare purchase involved no salespeople, no pressure and (so far) no regrets.

And before you discount me as someone who has no clue what I’m talking about or that’s in denial, I travel on points and miles a lot of the time, am pretty adept at hunting travel deals and used math to decide that this purchase was a good one for us.

Here’s why buying a timeshare made sense for me, even though it absolutely won’t — and shouldn’t — make sense for everyone.

Related: 5 things to know about renting a timeshare

Buying a timeshare that doesn’t call itself a timeshare

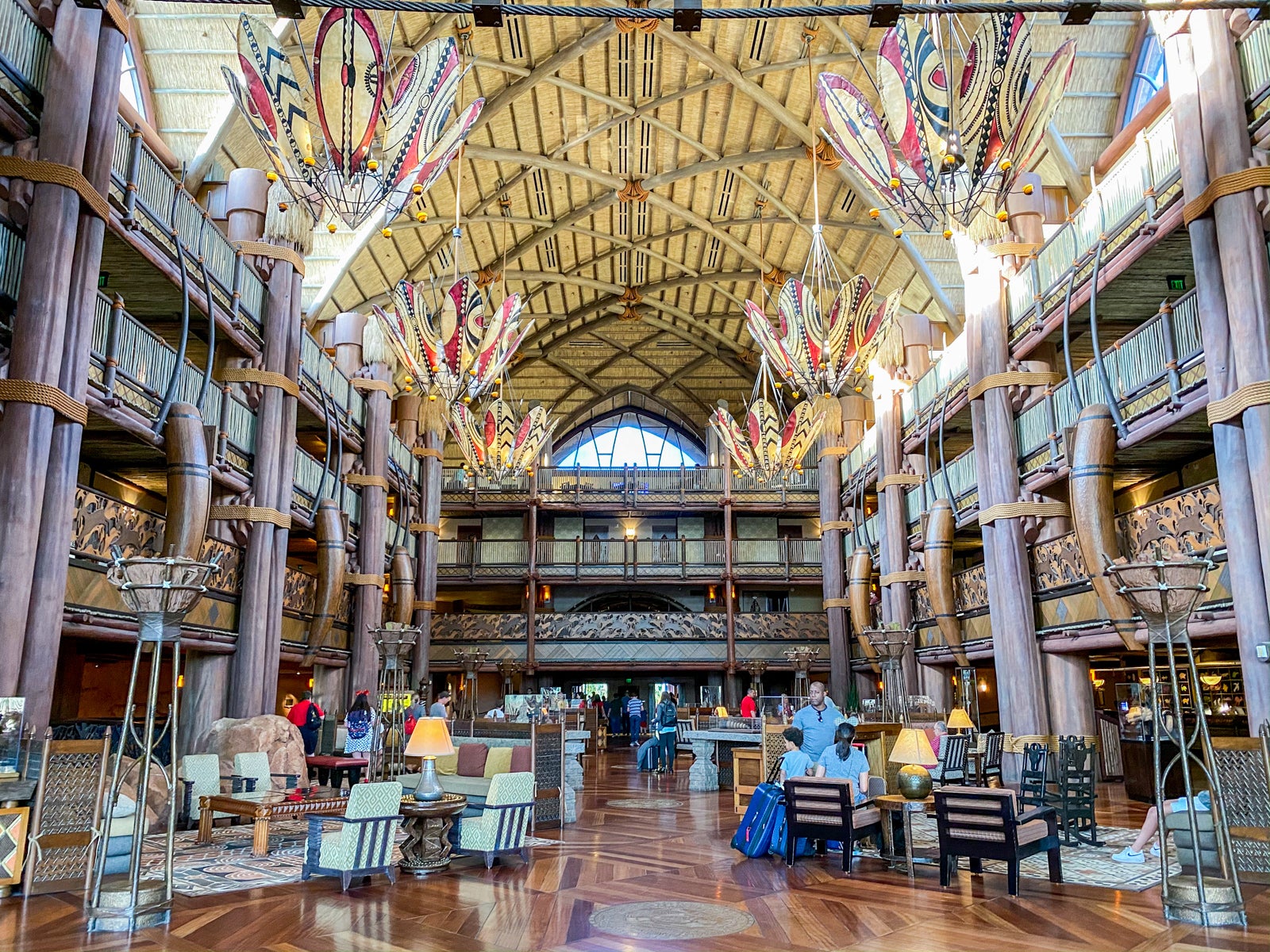

We bought two contracts in the Disney Vacation Club, which is Mickey’s version of a timeshare … even though that nine-letter word isn’t one Disney uses on its public branding. But make no mistake, what we bought is indeed a timeshare — or two, to be more accurate.

With the Disney Vacation Club, you purchase a set number of points tied to a specific resort to use each year through the end of the contract. An agreement at a new property, such as the new villas at the Disneyland Hotel, is valid for 50 years, while getting a contract at existing properties usually means a shorter time frame, with some being as short as 19 years, ending in 2042.

The two smaller contracts we bought are for Disney’s Aulani resort in Hawaii (expiring in 2062) and the Polynesian Village Resort at Walt Disney World (expiring in 2066), for a total of 155 annual points in the Disney Vacation Club program. While you have priority booking 11 months from the date of travel at your home resort where you “own,” you can use the points within seven months of travel at any Disney Vacation Club resort with availability — with some caveats that we’ll mostly leave for this guide we have on how the Disney Vacation Club works.

Both of our contacts were purchased on the resale market, which means we are paying significantly less than what Disney would want for a direct DVC membership. A downside of buying resale is you can only pick through existing contracts instead of crafting exactly what you might want to design from scratch. You also don’t get some of the discounts and perks that come from owning at least 150 DVC points directly from Disney (such as access to the DVC lounges in the parks and being eligible for some less expensive annual pass types).

I’ll get more into the numbers below, but we have a long track record of taking a variety of Disney vacations year after year, so I feel pretty confident that will continue for the foreseeable future. And I know what we often spend to stay at Disney resorts, which makes the math against the price to own easier. And there is a bustling market for renting DVC points that very much has my attention.

Related: How to rent Disney Vacation Club points to save money on Disney stays

Why now was the time to buy

While I’ve had a mild curiosity about becoming a Disney Vacation Club member for a few years — and have rented DVC points numerous times — there are a few reasons now was the time to purchase.

Disney has the first right of refusal to buy back all of its Disney Vacation Club contract resales. Once the buyer and the seller agree on a price, Disney then has 30 days to buy the contract back at that price itself, thus taking it away from its intended buyer. And historically, Disney really would exercise that right some of the time, especially on contracts where prices were low.

For example, according to the DVC Resale Market, a site that lists some DVC contracts for sale, by March 2022, Disney had already exercised its buy-back clause on 244 contracts that company had helped to sell by March that year. In contrast, by March this year, that buy-back number for the year was just four — and all of those were from January, with none shown since then.

With almost no Disney buybacks happening in the last few months, some contracts are selling at cheaper prices than historically was possible. With prices trending down, inventory trending up and Mickey not swooping in to buy back the best deals at a normal clip, now was the time for us to buy.

The math behind my timeshare purchase

Before I share our numbers, let me emphasize one more time that this isn’t for everyone — it’s not even right for most Disney aficionados. Smaller contacts also cost more per point than larger contacts, so you can get better deals on a per-point basis if you are willing to buy more points. We wanted to minimize risk by staying small, so we paid a bit more per point as a result. Here’s how it broke down for us.

For our Polynesian Village contact, we bought 55 points for $156 per point at a total cost (with dues, closing costs, etc.) of just over $9,300. For our Aulani contract, we bought 100 points for $108.50 per point for an all-in cost of just over $12,600. And yes, it is totally normal for some resorts to cost much more than others, as you see with our Aulani and Polynesian purchases. This is due to the cost of annual dues at each property, the desirability of booking further in advance at that property and the number of years left on the contract.

So for about $22,000, we now have 155 Disney Vacation Club points to use each year until the contacts expire. That cost may sound nuts by itself. But remember that at current rates, we also will owe $914 per year for dues on our Aulani points and $437.25 for our Polynesian points, and those numbers will likely only increase over time. So that means $1,351.25 per year just to own the points based on this year’s prices.

But here’s why it’s not as crazy as it likely initially sounds.

Right now, it is very realistic to rent your DVC points out for stays as an individual at $20 per point, with some getting higher or lower amounts. If we rented all 155 points out at that $20 rate in a year, that would mean getting $3,100, which way more than covers the dues. In fact, using current rates to rent out points and for dues (knowing both will likely increase as the years go by), we’d recoup the cost we spent to buy the contacts if we did that for 13 of the 39 years we will own both contacts — including the cost of the dues in the years we rent the points out.

Now, I’m not saying that’s my plan, but that’s the math. For those curious, per the terms, you can expressly rent out points, but not in a pattern that constitutes a commercial enterprise.

So now let’s talk about math when using the points, which we absolutely will do. You can use the points to stay at Disney resorts starting at just 7 points per night at Deluxe resorts such as Disney’s Animal Kingdom Lodge. By owning 155 per year, we have the opportunity to cover numerous nights at Disney with the points we now own if we are strategic about how and when we cash them in. But for now, let’s be extra conservative and say our stays in studio villas will average 20 points a night. With that math, we get between seven and eight nights a year out of our points.

If, for the 39 years that we own both contracts, we used all the points ourselves and got an average of 7.75 nights at high-end Disney resorts from our points using a 20-point per-night average, that’s a total of 302 hotel nights (not even counting the additional four years of stays on our Polynesian points).

Not counting annual dues, that comes to a “cost” of $72.85 per resort night from the all-in original purchase price. Using today’s cost of dues, then counting annual dues, that cost jumps to paying $247.35 per night. This amount will go up, but likely so will the average cost of hotel stays booked directly, so using today’s dollars should give an apples-to-apples idea of the cost.

That’s not a cheap nightly rate for a hotel, but if you take a look at the going nightly rate for a night at Disney’s Polynesian Village Resort, Aulani Resort, Disney’s Grand Floridian Resort & Spa and other spots we like to stay, rates are often $500-$700. And compared to that, $247.35 per night starts to look more like a deal. And remember, this was using a conservative average nightly points rate compared to where nightly points rates start, so the more nights we redeem for lower points, the lower the average rate we are “paying” per night.

When you then factor in that there are other options for the points in the years that you may not want to go to Disney, such as gifting family and friends or even renting them out a stay, the math starts — for us — starts to look less and less outrageous.

Related: These are the best hotels at Disney World

What happens if we don’t want it anymore — or die?

If it turns out that eventually, we don’t want to own one or both of these Disney Vacation Club memberships anymore before the deeds expire, we can put them up for resale.

The good news is we bought at resale prices, so while no one knows what the future market is for these contracts, hopefully, we’d be able to get out of the memberships without getting too upside down since we didn’t pay retail. So far, someone has always been willing to buy a DVC membership as long as the price is right, so it’s not a question currently of if you could sell, but for how much. But if no one bought them, we’d continue to be on the hook for the dues until we could offload them somehow. This is one reason we kept our purchase on the smaller side.

Since my husband and I are both on the deeds, if one of us dies while the deed is active, the other of us keeps on trucking with it. If we both die before the time is up on the deeds, or we sell them, then they become a piece of deeded real estate subjected to your will(s), those getting your inheritance, the probate process, etc.

Once our kids are adults, we could also add them to the deed(s) if it seems Disney is going to continue to be a part of their lives. Some people approach these purchases with a trust in mind as the owner. Naturally, there are implications to all of the proceeding options that would need to be worked out with lawyers and the like, so don’t take my word too seriously on any of that, but know that there are some implications of owning a deeded timeshare beyond just the cost.

Bottom line

Should any rational person spend $22,000 buying timeshares on the resale market — and still be on the hook for over $1,000 in annual dues for the next several decades for Disney resort stays? Maybe not. Probably not.

But on the other hand, after running the numbers many times and looking at our track record of vacations spanning more than the last decade, it started to feel absurd not to give this a try. And if it all goes south, then future me will hope that there’s someone out there like current me that thinks this is worth giving a try.

Related reading: