There are many reasons to add authorized users to your favorite travel credit cards. And unfortunately, one of the most popular ones for additional cardholders — the Citi® / AAdvantage® Executive World Elite Mastercard® — appears to be launching a notably negative change along these lines.

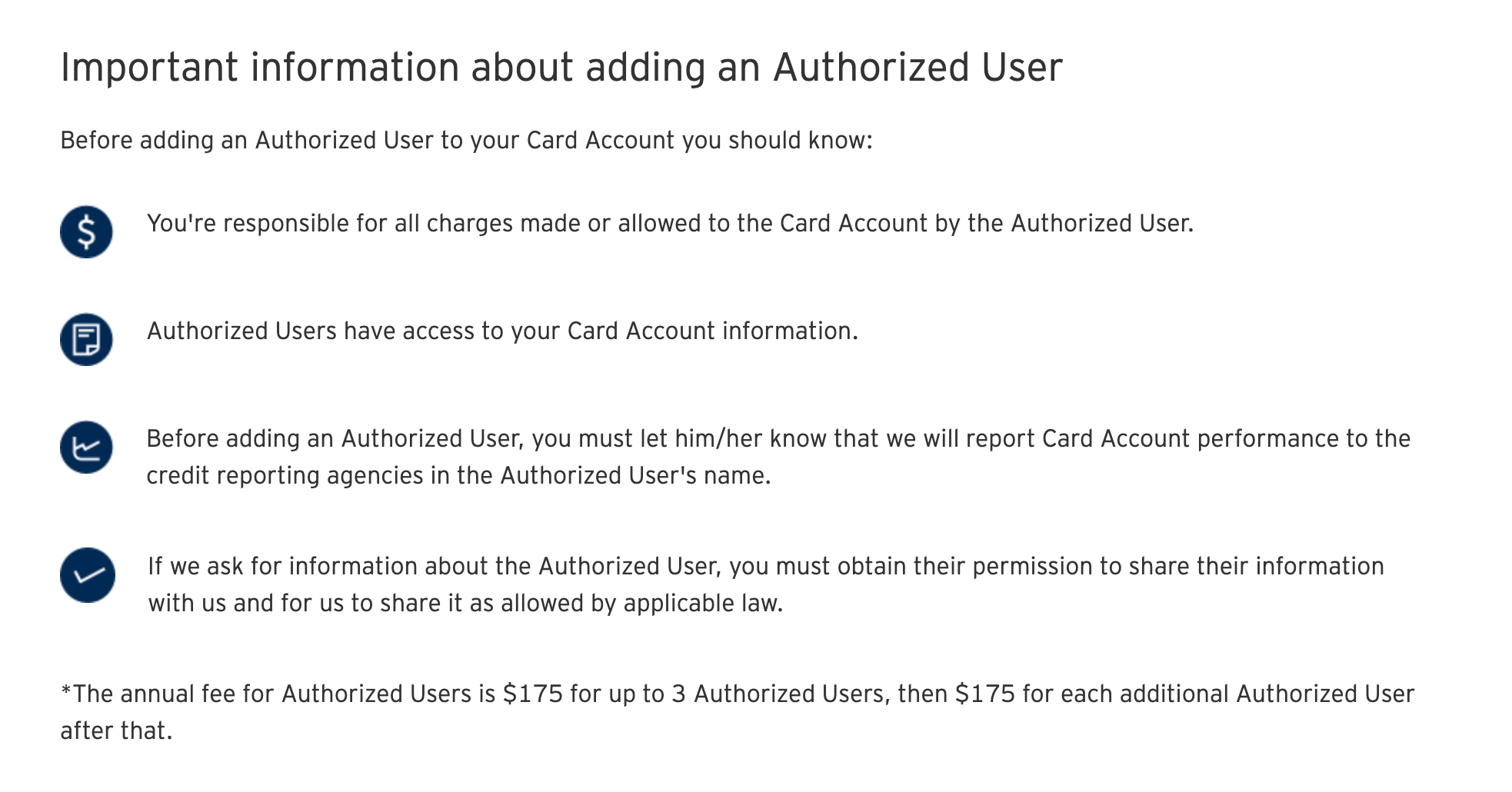

According to Citi.com, this card now imposes a $175 fee for adding up to three authorized users. Every user beyond that is another $175 apiece. This policy is listed in Citi’s online platform when you go to add an additional cardholder.

The card has always carried a $450 annual fee for the primary cardholder, but previously, you could add up to 10 authorized users for no additional charge. These individuals would then enjoy complimentary access to the Admirals Club when traveling on American or partner flights — including up to two guests (or your spouse and children under the age of 18). Now, these lounge privileges will come at a hefty additional cost.

If this sounds like a familiar fee structure, you’re right. It’s the exact same approach as The Platinum Card® from American Express, which imposes a $175 annual fee for the first three authorized users and then $175 apiece after that (see rates and fees).

However, additional Platinum cardholders can access a wide variety of lounges via Amex’s Global Lounge Collection — including the issuer’s own Centurion Lounges, Priority Pass, Plaza Premium and Delta Sky Clubs (when traveling on Delta). They also enjoy many other Platinum perks, like complimentary Gold status with both Marriott and Hilton.

Read more: Why you should add authorized users on your Amex Platinum Card

On the other hand, authorized users on the Citi AA Executive Card can only get into the roughly 50 Admirals Clubs worldwide. Other perks on the card — like priority boarding and a free checked bag on domestic itineraries — don’t apply. As a result, imposing the same fee as the Amex Platinum seems steep.

That said, this new fee structure is actually slightly better than the Delta SkyMiles® Reserve American Express Card, which imposes a $175 fee (see rates and fees) for every authorized user and doesn’t include guest privileges. (The United Club Infinite Card doesn’t charge for authorized users, but they don’t get United Club access unless they’re traveling with the primary cardholder.)

We’ve covered lounge overcrowding extensively here at TPG, and these stories will likely continue as the busy summer travel season ramps up. This new policy is almost certainly an attempted solution to these problems — though anecdotally, Admirals Clubs seem to be affected less frequently than Delta Sky Clubs and United Clubs.

There are several outstanding questions about this new policy. Most importantly, when will this fee kick in for existing cardholders? The Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act) requires at least 45 days advance written notice for any significant change to a term or cardholder agreement — “including an increase in any fee.” I looked through all of my 2023 statements and haven’t seen any notice addressing this potential change.

Bottom line

Based on a new policy posted on Citi.com, it appears that the Citi® / AAdvantage® Executive World Elite Mastercard® is now imposing annual fees for authorized users — specifically $175 for the first three and then $175 each beyond that. However, it’s still unclear how this will affect existing customers who already have free additional cardholders on their accounts. In addition, it’s still not listed on the application page for new cardholders at the time of writing.

Of course, paying the equivalent of $58 apiece for three authorized users can still be a relative bargain — especially for frequent American travelers who can benefit from Admirals Club access. Nevertheless, this is unequivocally a negative change to one of the best credit card perks out there.

We’ve reached out to Citi for clarification on this information and will update this story when we receive additional details.